The number of Portuguese people working on green receipts is increasing day by day for a variety of reasons.

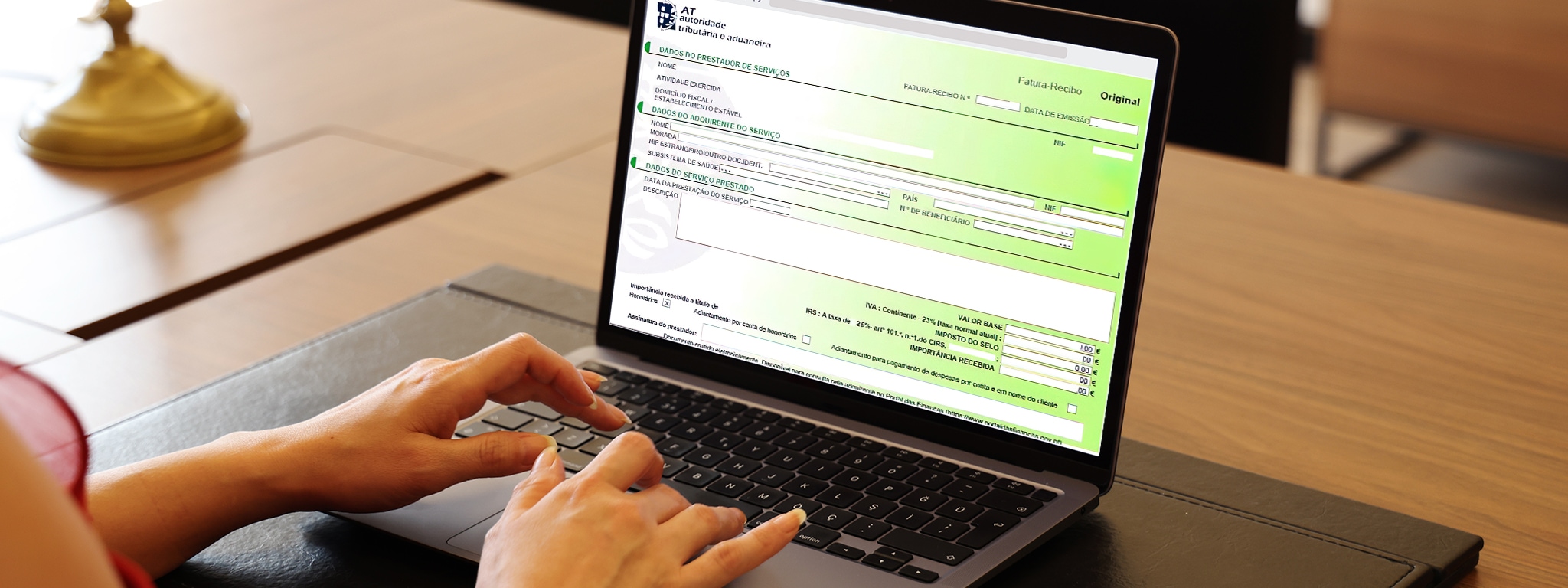

Green receipts are invoices, or receipt-invoices, issued by self-employed workers for the provision of services or the sale of goods.

If, on the one hand, working as an independent person has some advantages, on the other hand, there are the dreaded disadvantages. It is therefore important to find out about the subject before deciding to take this step.

Can anyone issue green receipts?

The answer is yes, as long as you have a TIN and legally live in Portugal.

The process is simple, and for that it is only necessary to open activity in Finance and define the activity you want to develop, from the choice of activity code (CAE).

In the first year of activity, a self-employed worker is “exempt” from paying Social Security contributions.

If you have an annual turnover of less than €12,500, you are covered by the VAT exemption regime (Article 53 of the VAT Code).

When in a year you exceed €12,500 in billing, you are now subject to payment of VAT in year N+1 and then in January you have to change your activity, starting to be obliged to make quarterly deliveries of VAT or monthly, according to the regime you are subject to.

Advantages

Regarding the strengths of working with green receipts, we can list some such as:

- Autonomy and Independence – There is no relationship of subordination to the company that hires its services, that is, there is no hierarchical “boss-employee” relationship. A self-employed person is his own boss.

- Flexibility of hours and place of work – Since, as mentioned above, if you opt for this regime, you become your own boss, you can then choose the time and place of work that you want most.

- Working for several entities – A self-employed worker is free to provide services to as many entities as he wants, which, in principle, will allow him to increase his turnover. You can combine an employee job, that is with an employment contract, with other activities, unless your employer requires exclusivity. You are allowed to have two professional activities at the same time and declare the total income to Finance.

Disadvantages

But as nothing in this life is a bed of roses, if on the one hand the advantages are quite attractive, the disadvantages can make the scenario a little darker. These are some of them:

- There is no fixed salary – The “salary” at the end of the month depends on the self-employed worker, the greater or lesser volume of work, their budgets and their approval by the entities that contracted the service.

- Less stability – The fact that there is no fixed salary means that, consequently, there is less stability. This is the factor that can most influence the choice for this regime.

- There is no right to subsidies – If you opt for the self-employed regime, you will no longer have the Christmas and holiday subsidies that employees with a contract are entitled to.

- False Green Receipts – Although nowadays all information is accessible to anyone, there are many entities that still do not understand the working method of those who provide services with green receipts, requiring workers to comply with working hours and be obligatorily in the location that the entity intends. This is a type of requirement that goes completely against this regime, since the worker has complete freedom to define these criteria.

It is extremely important that you stay informed and that you are aware of all the pros and cons of green receipts if your goal is to become self-employed. This is an essential condition for not jeopardizing your contributory career and, above all, not losing money.